Newsletter #1 - Serie A & broadcast rights: The canary in the coal mine?

Why Serie A's rights renewal is a warning shot to Europe's top five leagues that the good times might be over

When TV turns bad…

The Game within the Game will look to cover the football digital media publishing industry, and hopefully provide advice and support for outlets navigating an increasingly uncertain and volatile space.

But…

How football itself generates revenue is intrinsically part of that, and how it will change going forward seems like a good place to start. Because if no-one’s watching football, is anyone reading about it?

Serie A’s new broadcast deal

Which brings us to Serie A’s domestic broadcast rights. Here’s what happened, at-a-glance:

Serie A’s current deal with DAZN and Sky, worth €927m per season, expires in 2024

Serie A were bullish, even under current market conditions, about sealing an extension in excess of €1 Billion per season

Instead they negotiated a €900m deal with DAZN and Sky until 2029

This represents not only a 3% decrease, but is also secured over a longer period (five years over the regular three)

By comparison, the Premier League will earn more than the full value of the new agreement in just a single year by way of domestic and international rights deals combined

What does this mean?

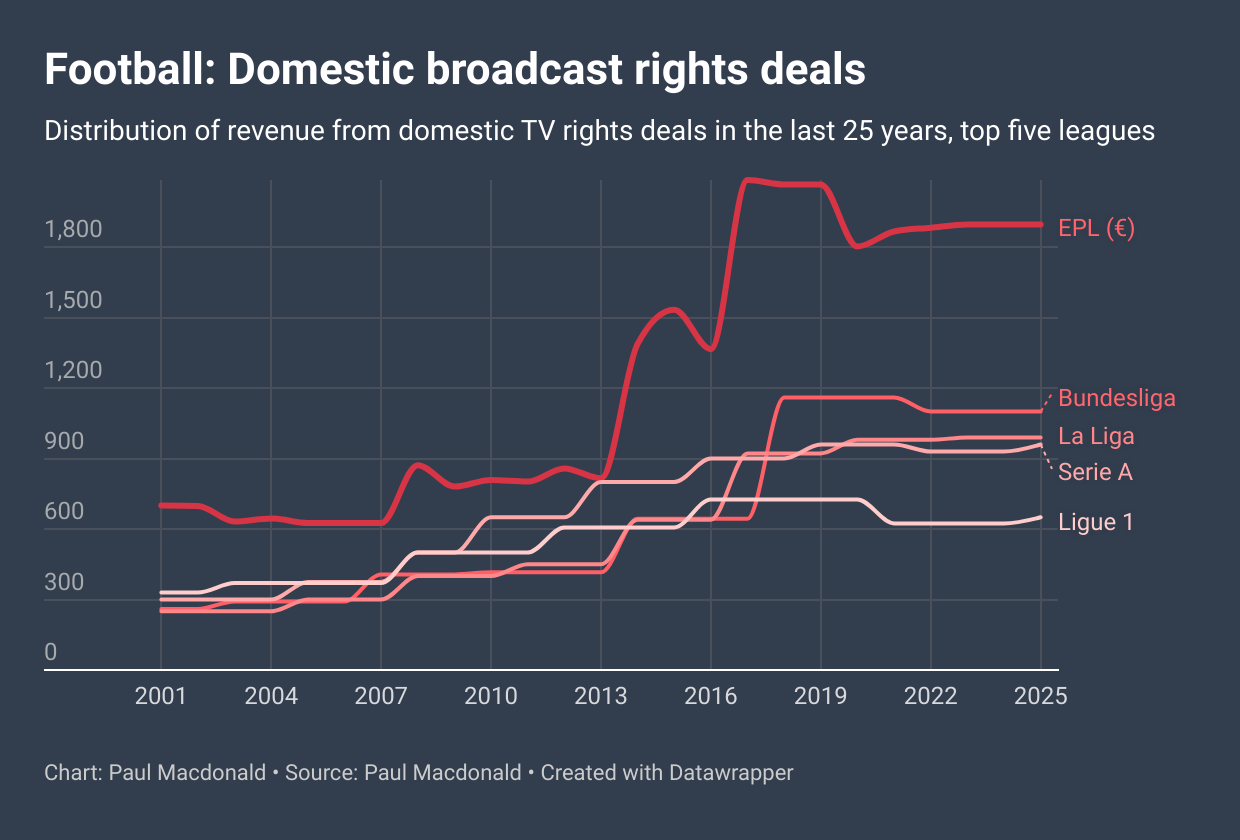

It means that the cycle of rises that has occurred in domestic broadcast rights deals since the early 2000s looks to be coming to an end. And that isn’t good news.

It has been an easy revenue stream to manage and relatively easy to negotiate for governing bodies. They grant access to the matches and the rights holder does the rest.

But in a market of rabid cord-cutting and the questioning of the determinate value of rights, we haven’t just plateaued, we have came over the other side of the mountain.

As the above image shows, the Premier League is already WAY out out in front of the other perceived ‘Big Five’ European leagues, earning roughly €1 Billion more per season than their closest challengers, the Bundesliga.

But post coronavirus, even the biggest league in the world is anticipating having to increase their package in order to maintain their current value. The EPL are looking to offer 270 games instead of 200 to give more matches to broadcasters for roughly the same outlay.

This should allow them to maintain a clear advantage over the rest of Europe. But others won’t be so lucky. In some respects Serie A have been spooked by the situation befalling Ligue 1. Like the Italians, Ligue 1 hoped for a big increase in their domestic package. Instead, they have had been forced to temporarily remove their tender offer as the bids were nowhere near what they had hoped.

Their current deal is already worth only 33% of the Premier League each and every year.

Image #2 merely undermines the gap between EPL and the rest. The EPL’s international rights offering is worth more than 2.5 times La Liga’s agreements and that remains in rude health.

It’s worth noting the derisory international totals for the other leagues in comparison to explain the gaping chasm between the EPL and the rest.

But what about the NBA?

Yes, it’s true. The NBA are chasing down a transformation 2x or 2.5 times increase on their current TV deal, which would take them potentially above $50 Billion - or further - over the next decade.

But the NBA have achieved things European leagues have not; engagement with a young audience, particularly in the democratic way in which highlights and action can be shared, but they have also drawn comfortably the most consistent numbers that the tradition cord providers, such as ESPN, can rely upon.

Europe’s biggest matches can do that - but not at the level of consistency the NBA has achieved and, in the case of the EPL, it can be argued that adding another 70 matches live will unquestionably welcome an era of diminishing returns.

Conclusion

The EPL, if they emerge largely unscathed from this latest broadcast tender round, will have solidified their position as the dominant league in the world.

They move closer to being the NFL than ever before, where there are lower earning and lower viewed versions of the product in other territories, but with the players in particular looking to make that step up whenever possible - to where the money resides.

But Serie A’s ambition - and ultimate failure - in the broadcast market is a clear warning that the one largely stable revenue stream, and the most lucrative one, is no longer guaranteed.

Football needs to get creative with alternative revenue models - and fast.

What does it mean for publishers?

An ever-greater consolidation of key talent into the English Premier League

A lack of talent and likely reduced global interest in Serie A

Could lead to a conversation around coverage of Italian teams - is it worth it?

Lack of competition in Champions League from Italian teams

More competition in covering an ever-decreasing circle of global teams?

Visit FootballTransfers to check our market-leading expected transfer valuation tool for over 150,000 footballers in our database. Built in collaboration with SciSports.

Great analysis - thanks. Two words spring to mind when I look at that situation in FR, ES & IT (the Germans won't be interested): Super League. Looking forward to future editions, Paul!